The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g.

Irs carpet depreciation life.

Depreciation or amortization on any asset on a corporate income tax return other than form 1120 s u s.

For further information you can refer to the table of class lives and recovery periods in irs publication 946 how to depreciate property.

Income tax return for an s corporation regardless of when it was placed in service.

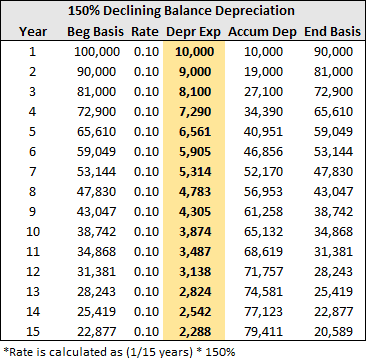

Useful life of more than 4 but less than 10 years that is 5 9 years.

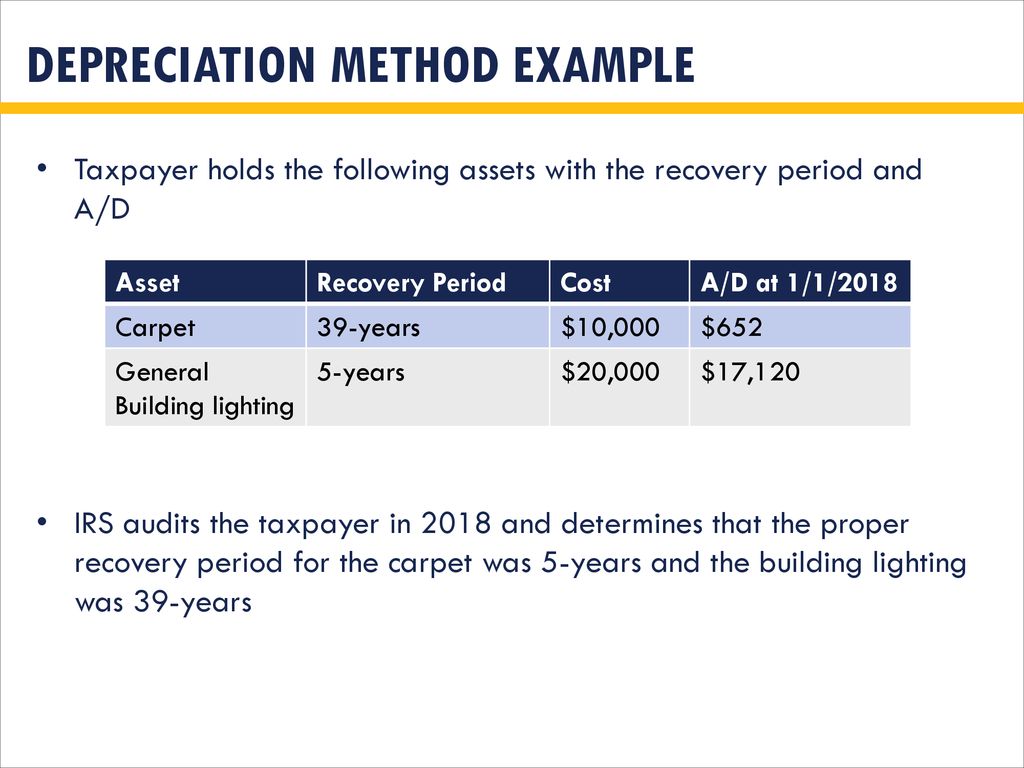

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674.

Depreciation life of asset to determine the classification of property being depreciated whether it is 3 year property 5 year property etc refer to the irs instructions for form 4562.

Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.